There are various pieces of evidence exist confirming that put options on wide equity indices are permanently overpriced by the market. The excess demand for the long portfolio protection is believed to be the main reason for this.

This research conducted using the OptionSmile platform underpins that observation and confirms that a put options selling has abnormally high expected profit.

However, on the risk-adjusted basis, such a short put strategy does not look so attractive due to the high volatility of results and regular huge drawdowns: the Sharpe ratio of a put selling, even with limited risk (spread strategy), is not so attractive and does not differ significantly from the Sharpe ratio of the outright long position in the underlying security.

Therefore, that high profitability of puts should be considered as a volatility premium rather than a market inefficiency.

Covered Call is a popular strategy that is often considered as a source of additional income for a long-term equity investor. Writing OTM calls is supposed to be a conservative strategy an average investor can pursue to earn a supplementary gain in excess of the underlying assets return.

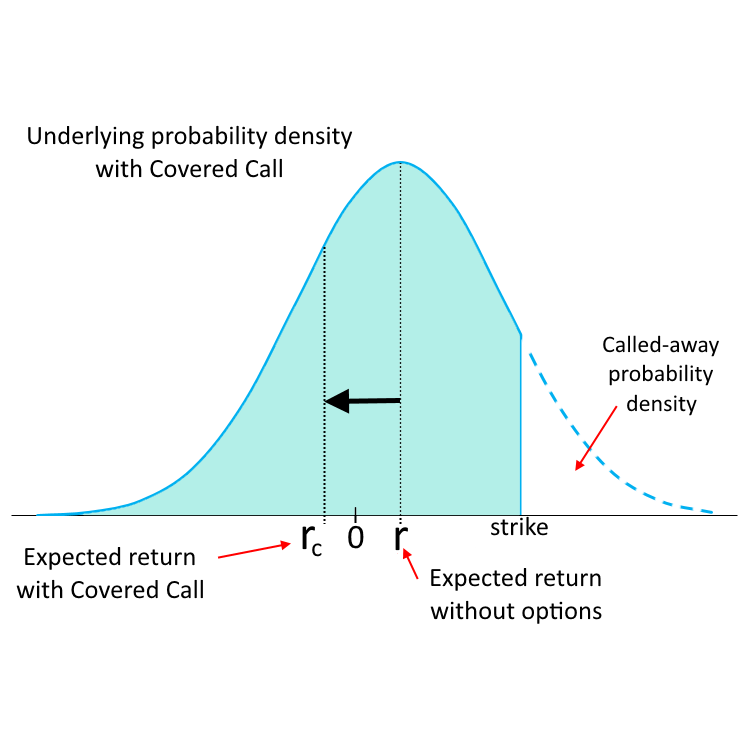

However, it turns out that the call overwriting against the major equity indices does not add any meaningful profit to the portfolio because almost all the premium collected from the short calls will eventually be lost in the form of not participating in the growth of the underlying security called-out in the cases of ITM expiration.

This research demonstrates that call options on equity indices are priced quite fairly on average (in the contrast to puts) and usually have expected profit/loss close to zero. Moreover, in the secular bull markets, they are mostly underpriced, and Covered Call imposes a drag on the portfolio performance.

Nevertheless, on a risk-adjusted basis, this strategy can be quite attractive, especially for the ITM calls selling.