Despite the fact that we have no listed options on cryptocurrencies yet (Feb 2018), it would be interesting to calculate their theoretical Fair Values. In fact, it is quite an easy task since we have a series of historical quotes of an underlying cryptocurrency.

According to the OptionSmile methodology, we just need to build a probability distribution of historical returns and then, for any given expiration/moneyness, calculate the probability of in-the-money expiration (Pitm) and conditional expected value (payoff) in such expirations (EVitm).

That is just a theoretical exercise, of course, without a practical application. Not only due to the absence of an opportunity to trade these contracts but also because of the huge diversity of market regimes that took place in the past for these assets. Combining together the prolonged periods of extreme uptrends and the following crashes will inevitably produce a mixed bag of regimes that will have quite a poor prediction power.

Nevertheless, it is still interesting to look at the results in comparison with the regular, more mature instruments like stocks and ETFs. Just for the sake of curiosity.

Unfortunately, there is no single reliable source of cryptocurrency quotes exist. However, for our experiment with the Bitcoin hypothetical options, we have taken the historical end-of-date quotes provided by Yahoo Finance for the 7.5-year period from June 16, 2010 to February 26, 2018. From now, it is accessible in OptionSmile Studio, with daily updates.

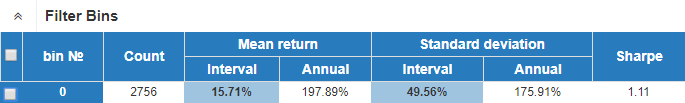

Let's take 20-day returns (just arbitrary number) and look at the underlying returns statistics:

As expected, the average return is quite high - 15.7% per 20-day interval. However, it is also accompanied by huge volatility - around 50%. All these numbers annualized give us not so impressive 1.1 Sharpe ratio.

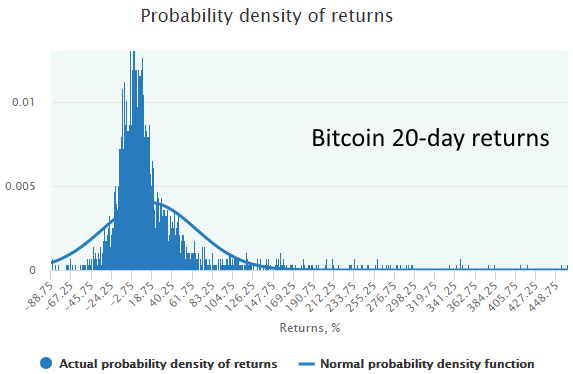

Here is the probability density of 20-day Bitcoin returns:

Very high kurtosis and huge positive tail are obvious, and all that has a significant impact on the valuation of our hypothetical option contracts. Let's look more closely at it.

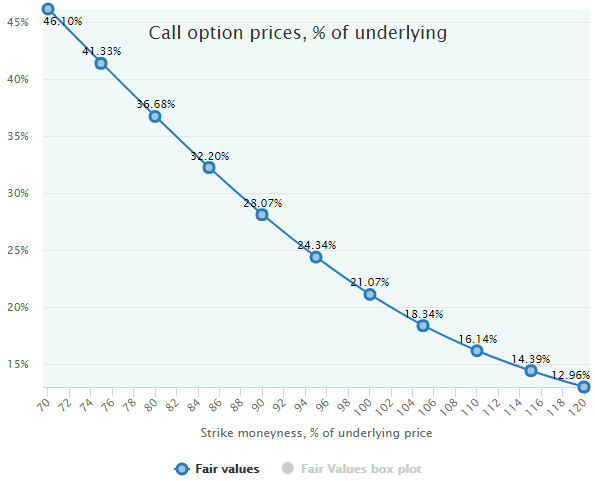

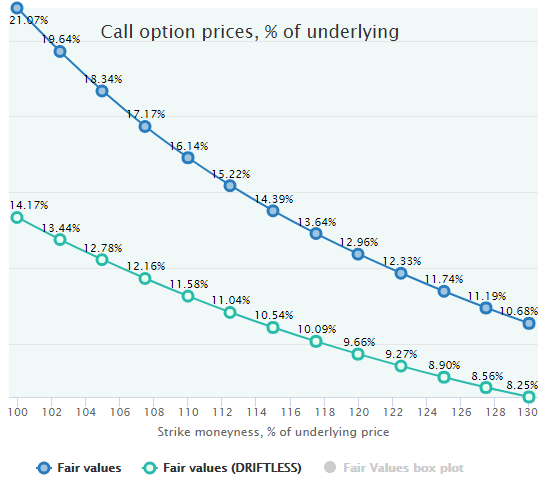

Here are the Fair Values of imaginary 20-day Bitcoin call options based on the same 7.5-year period:

Obviously, the Fair Values are very high. It is almost impossible to find a regular financial asset having the price for at-the-money calls (100 moneyness) equal to 21.07% (!) of underlying. Overall, the time value of more than 20% for 20-day options looks fantastic even in comparison to the most volatile optionable assets.

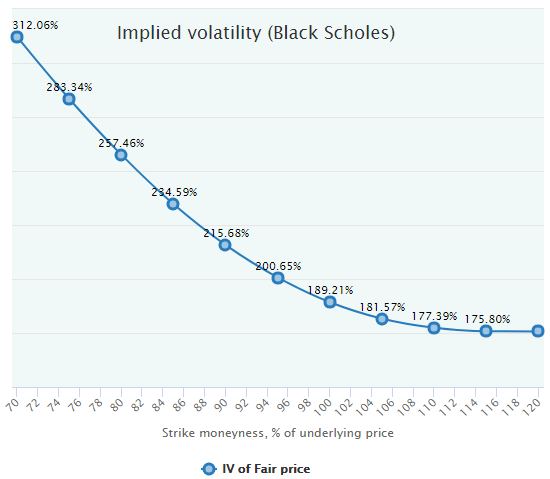

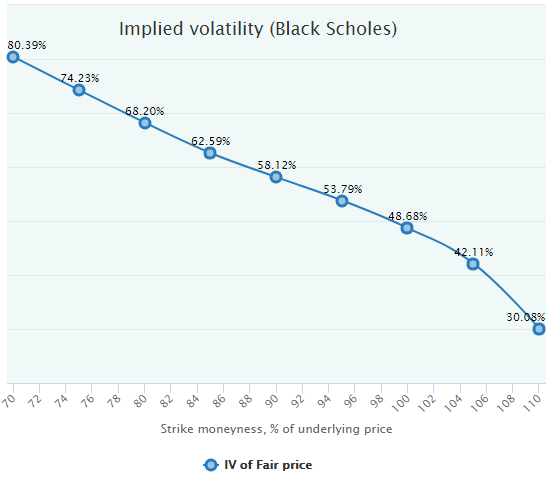

No surprise, the implied volatility according to the Black-Scholes model is also extremely high:

Besides the absolute level of more than 200%, it is interesting to note the shape of this "smirk". Despite the significant positive mean return and the "fat" positive tail of the Bitcoin returns distribution (see above), the right-hand side implied volatility is elevated relative to the left-hand side.

Really, that shape of the "volatility smile" is not typical for such a "right-fat-tailed" distribution. One should have expected more commodity-like "smirk" with higher positive wing and lower negative one. It definitely deserves more thorough research.

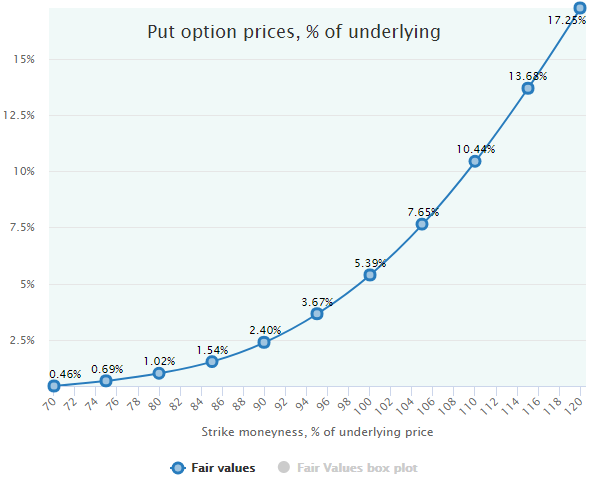

The following are the same charts for the put options on Bitcoin calculated for the same dates range and the same 20-day interval:

Interestingly enough, the Fair values of the deep-in-the-money put options (moneyness > 110) are less than their "intrinsic" values (it is impossible to find IVs for such prices). It usually takes place when the underlying returns distribution has a strong positive drift exceeding the risk-free rate by far, which is true in our case, see the charts above.

Also, note that the put options IV is substantially less than the calls one. It is also logical and also takes place due to the strong positive drift in the Bitcoin returns distribution, while Black-Sholes model assumes the drift being equal to the risk-free rate (risk-neutral valuation). For more about the empirical put-call parity, see this blog post.

Overall, that positive drift of Bitcoin prices has a huge impact on our theoretical option Fair Values. Let's look at the fair prices in comparison with the same values with the drift elimination (for more about this logic, see Driftless Option Fair Value).

Here are the call options (OTM strikes) with Driftless Fair Values series:

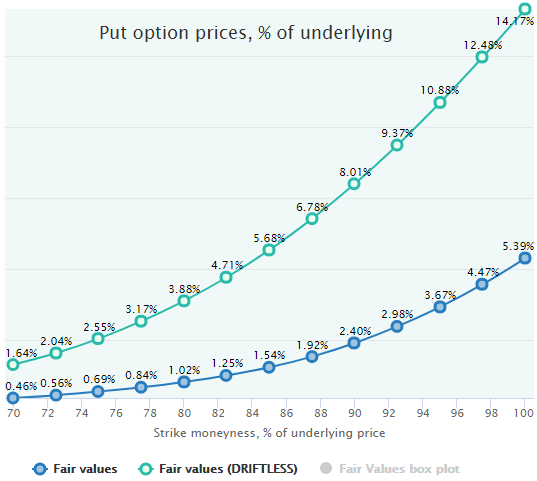

The similar chart for the put OTM options:

Obviously, the observed Bitcoin uptrend in responsible for a big part of its option values: it lifts the prices of calls and decreases the puts valuation.

In any case, as it was mentioned above, it is difficult to extrapolate these Fair Values to the future. It is necessary to admit, that in contrast to the conventional and optionable assets (indices, stocks, ETFs) which have a long history of repetitive price patterns, all cryptocurrencies have had very short history and have been going through very diverse and still unique market regimes. The identification and analysis of all these regimes is, obviously, the topic for another research.

All OptionSmile Studio users can conduct their own similar research with Bitcoin and other cryptocurrencies (like Ethereum and others).