All three equity indices have jumped to their highs of the recent months entering the slightly oversold territory. Volatility indices are at their lows since January.

SPY and QQQ return statistics indicate that even in an oversold regime they both tend to either move higher or stay on the achieved levels. Implied volatility is usually low but puts are still overpriced due to the not that big probability of a significant move downward. Meanwhile, IWM has another character in this regime since it is more susceptible to the negative news and usually more ready to correct down. Combination of such behavior with low option prices makes IWM near-the-money puts underpriced.

Call options are priced fairly except for ATM calls on IWM.

Mispricing summary for the options with two to five weeks until expiration:

| Puts | Calls | |||

| OTM | ATM | ATM | OTM | |

| SPY |

Near-term expirations – Fairly priced Farther expirations – Overpriced substantially |

Fairly priced | Fairly priced | |

| QQQ | Overpriced | Overpriced | Fairly priced | Fairly priced |

| IWM |

Near-term expirations – Fairly priced Farther expirations – Overpriced |

Near-term expirations – Underpriced Farther expirations – Fairly priced |

Overpriced | Fairly priced |

Major opportunities are observed mostly in puts: SPY and QQQ with 4-5 weeks till expiration. IWM ATM near-term long puts can be considered as a directional play with downward move expectation.

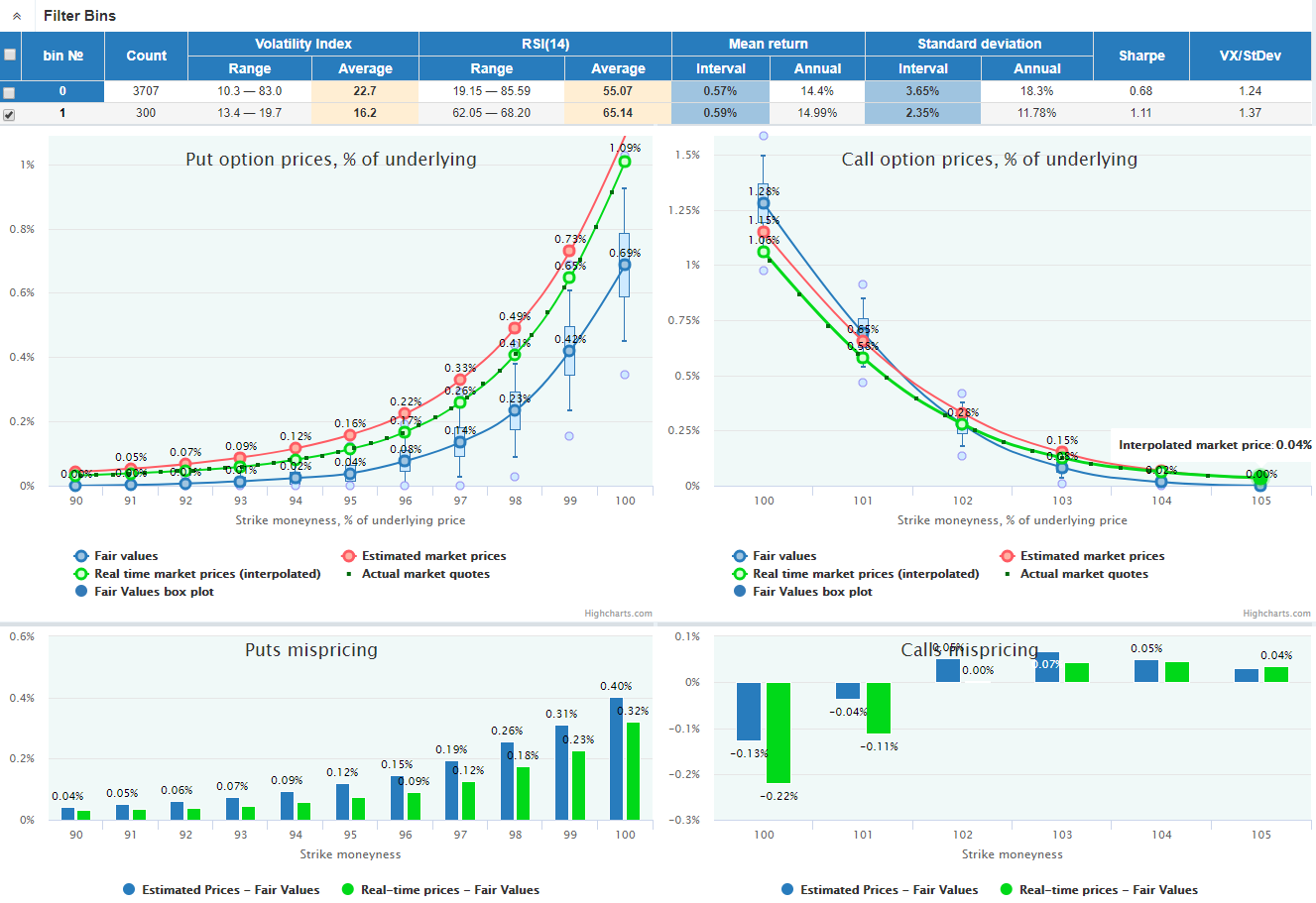

To make our estimation more reliable, we filter the historical data and select from the past only those dates when the market resembled the current condition (read more here). We use three filters:

We apply auto filtering for Volatility index and RSI selecting 300 days in history with the shortest Euclidean distance to their current values.

For each underlying, we select expirations on a range of 2-5 weeks. We present mispricing charts for each expiration and basic PL metrics for the best one-leg strategy (buying or selling put or call) measured by the Expected profit (annualized).

SPY has broken up its 260-270 range; RSI(14) is above 60 level demonstrating slightly oversold condition.

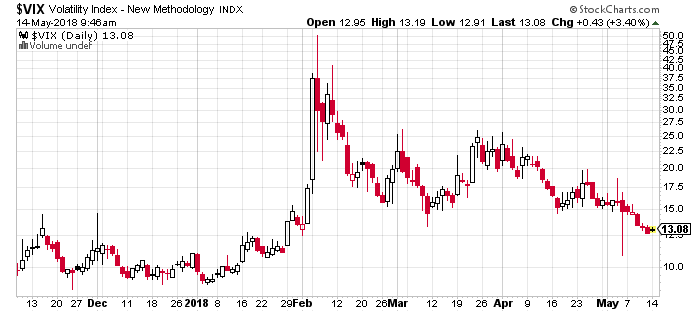

VIX has broken to the downside demonstrating the lowest level since January this year:

Puts are overpriced, calls are underpriced but not significantly:

Puts are overpriced mostly OTM; calls are priced fairly:

Puts are substantially overpriced, especially OTM; calls are priced fairly:

Puts are substantially overpriced; calls are priced fairly. Market prices are adjusted for the June 15 dividend

Short Put PL metrics for June 15 expiration:

QQQ has also broken the recent range to the upside moving closer to the all-time highs; RSI(14) shows slightly overbought condition:

VXN continued its short-term downtrend posting the lowest level since January this year::

Puts are overpriced; calls are priced fairly:

Puts are overpriced; calls are priced fairly:

Puts are overpriced; calls are priced fairly:

Puts are overpriced; calls are priced fairly:

Short Put PL metrics for June 1 expiration:

IWM has jumped to its all-time high levels; RSI(14) demonstrates slightly overbought condition:

RVX has moved to its January lows:

OTM puts and calls are priced fairly; ATM puts are underpriced:

OTM puts and calls are priced fairly; ATM puts are underpriced:

OTM puts are overpriced, ATM puts are priced fairly; calls are overpriced but not significantly:

OTM puts are overpriced significantly, ATM puts are priced fairly; calls are overpriced:

Short Put PL metrics for June 15 expiration:

Short Call PL metrics for June 15 expiration: